Bridging the gap: storage & distribution in the hydrogen value chain, IDTechEx report.

In recent years, interest and activity in the hydrogen sector have accelerated, driven by governments recognizing hydrogen’s role in the energy transition and companies worldwide capitalizing on emerging market opportunities through the supply of services, products, technologies, and projects.

While much focus has been placed on the upstream development of low-carbon hydrogen production sites (both green and blue) and downstream advancements in fuel cell technologies and industrial use cases of hydrogen, the midstream infrastructure needed to store and transport hydrogen has often received less consideration.

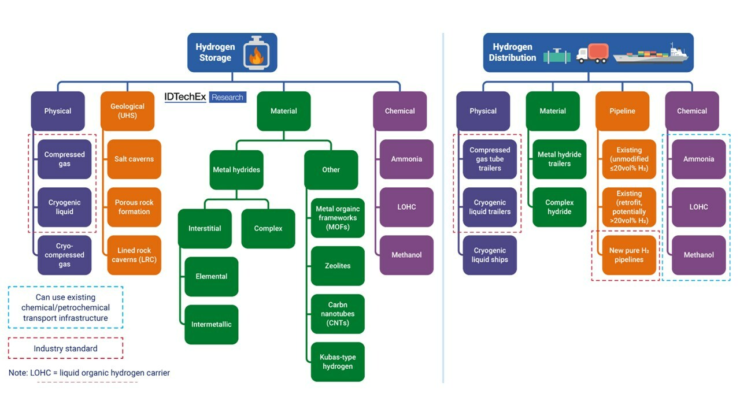

The development of this critical link in the value chain is vital for ensuring the full potential of hydrogen as an industrial feedstock, fuel, and energy carrier, bridging the gap between production and consumption. A broad spectrum of solutions exists for hydrogen transportation and storage.

🔥 What about we co-host a webinar? Let's educate, captivate, and convert the hydrogen economy!

Hydrogen Central is the global go-to online magazine for the hydrogen economy, we can help you host impactful webinars that become a global reference on your topic and are an evergreen source of leads. Click here to request more details

This article delves into the subject of hydrogen storage and distribution technologies, examining their use cases and highlighting recent commercial activities in this domain. For a more in-depth exploration of each technology and associated commercial activities, please refer to IDTechEx’s new market report, “Hydrogen Economy 2023-2033: Production, Storage, Distribution & Applications“.

The Need for Hydrogen Storage & Distribution

Despite its impressive gravimetric energy density, one of the main challenges with hydrogen is the complexity of its storage and transportation. This stems from its extremely low density at ambient conditions leading to low volumetric energy density. Consequently, significant compression (100 to 700 bar) or liquefaction at an extreme boiling point of -253°C is necessary to enhance its volumetric energy density for storing and transporting adequate amounts.

Although mature, incumbent compressed gas and cryogenic liquid storage methods have significant disadvantages. These methods are energy-intensive, diminishing the hydrogen’s net energy content. Compression consumes 10-30% of the original energy, while liquefaction can use up to 30-40%, with the added burden of requiring a separate liquefaction plant, entailing considerable capital investment.

Such inefficiencies significantly hinder some applications, such as FCEV mobility and energy storage, by sharply lowering the overall energy efficiency. Safety risks with compressed gas storage and boil-off issues with liquid H2 storage lead to hydrogen loss, further exacerbating the challenges. Collectively, these factors make both domestic and international transport of hydrogen expensive and inefficient.

Globally, hydrogen pipelines do exist, totaling an estimated 5,000 km, but their reach is largely restricted to specific regions like parts of Texas and Louisiana around the Gulf Coast or areas in France, Belgium, Netherlands, and Germany.

Typically operated by industrial gas giants like Air Products, Linde, and Air Liquide, these pipelines serve industrial facilities such as refineries within a limited range of production sites. This confinement emphasizes the pressing need to expand pipeline networks to connect varying regions of production and consumption more widely.

Hydrogen Storage Options and Their Use Cases

Many solutions are available, but the optimal choice depends on storage size and application. Compressed gas and liquid hydrogen storage tanks will likely continue to serve stationary storage applications, such as hydrogen refueling stations. Liquid hydrogen spheres may be used to store large quantities at production sites and import/export terminals.

Established players like Tenaris (compressed gas storage), Chart Industries (liquid H2 tanks), and McDermott CB&I (liquid H2 spherical vessels) already supply these well-commercialized solutions.

Compressed hydrogen tanks, especially Type III and IV composites are gaining traction in the FCEV market, as they are most suitable to store hydrogen on-board of a vehicle. Many FCEVs, such as the Hyundai Nexo and Toyota Mirai, use Type IV tanks storing hydrogen at 700 bar. Compressed storage is expected to persist in many FCEV segments, dominating light-duty ones.

However, liquid hydrogen (LH2) tanks present the advantage of higher capacities, which could be beneficial for the heavy-duty segments. Hence, some companies, like Daimler Truck, are trialing the use of LH2.

Storage systems using metal hydrides show promise for stationary applications similar to existing compressed and liquid H2 systems. These systems, which operate at much lower pressures (10-50 bar) and use pressure cycling for adsorption/release, may be more suitable for hydrogen energy storage applications due to reduced energy consumption and, thus, improved round-trip efficiency.

Companies like GKN Hydrogen are progressing towards commercialization, having demonstrated their systems in off-grid energy storage and residential combined heat and power (CHP). Many more companies are developing systems based on metal hydrides.

Underground hydrogen storage, utilizing reservoirs like salt caverns, builds on established natural gas storage methods. Integration of such facilities into hydrogen pipeline networks is planned by operators like Uniper and Gasunie in the coming years.

Underground storage is expected to play a key role in seasonal hydrogen storage to supply sectors in times of lower demand, like natural gas storage. Underground facilities may also be used by industrial projects as a buffer reserve of hydrogen – HYBRIT, a sustainable steelmaking project in Sweden, is testing such a concept using a lined rock cavern (LRC). However, regulation and long project development times remain key challenges for this storage type.

Hydrogen Distribution Options and Their Use Cases

Currently, compressed and liquid hydrogen trailers supply smaller scale applications like refueling stations or pilot projects. This trend is likely to continue as large-scale transportation where continuous hydrogen supplies are needed may not be viable with these methods. Many types of vessels could be used in terms of compressed gas transport, from Type I to IV, developed by companies like Hexagon Purus. Other companies, such as LIFTE H2, are using trailer concepts to develop mobile refuelers, which can compensate for the lack of a hydrogen refueling station.

Larger scale and longer-distance transport will necessitate pipelines, either running directly from production to end-use sites or feeding into pipeline networks. New construction is planned, with some projects like the HyNet North West Hydrogen Pipeline already underway. Repurposing natural gas pipelines is a possibility but requires extensive simulation, testing, and risk evaluation to identify suitable pipelines.

The European Hydrogen Backbone initiative is a leading initiative in terms of developing a large-scale pipeline network, with over 30 operators participating – many of the pipelines that will be used are planned to be repurposed from existing networks.

Blending hydrogen into natural gas is also a popular topic as it is a way of partially decarbonizing the heating and power sector, with projects like HyDeploy proving a blend of 20 vol% being safe in existing pipelines. However, a higher percentage of hydrogen blends will require the modification of many appliances and equipment in the residential and industrial sectors.

International long-distance transport may involve liquid hydrogen or conversion to hydrogen carriers like ammonia or LOHC. Liquid hydrogen transport was demonstrated by the Suiso Frontier vessel (built by Kawasaki Heavy Industries) in the HESC project, transporting hydrogen from Australia to Japan. However, this pathway may be less viable compared to carriers due to the technical and commercial difficulties of dealing with liquid hydrogen.

The advantage of using hydrogen carriers is the utilization of existing transport routes and vessels, albeit requiring additional processing facilities. Companies like Chiyoda Corporation and Hydrogenious LOHC Technologies are on the path of commercializing their LOHC solutions. An ammonia receiving terminal is also planned at the Port of Rotterdam as a collaboration between Royal Vopak, Gasunie, and HES International. Many more companies globally are also seeing ammonia as the more viable option.

Future Directions & Further Insights

The global embrace of hydrogen storage and distribution technologies will expand as production and end-use sites increase. This represents an opportunity for product supply, project development, and R&D to innovate and refine existing methods. IDTechEx projects the global low-carbon hydrogen production market to reach US$130 billion by 2033, expecting substantial growth in transport and storage solutions.

The new “Hydrogen Economy 2023-2033: Production, Storage, Distribution & Applications” report offers an exhaustive overview of the value chain, including technological analyses, comparisons, commercial activities, innovations, and market trends.

To find out more about this IDTechEx report, including downloadable sample pages, please visit www.IDTechEx.com/hydrogeneconomy.

About IDTechEx

IDTechEx guides your strategic business decisions through its Research, Subscription and Consultancy products, helping you profit from emerging technologies. For more information, contact research@IDTechEx.com or visit www.IDTechEx.com.

Bridging the Gap: Storage & Distribution in the Hydrogen Value Chain, IDTechEx Report, BOSTON, August 15, 2023