The battle for the US hydrogen production tax credits.

President Biden’s top advisers recently argued that the Inflation Reduction Act (IRA) will be a climate game changer for two reasons: first, by putting domestic emissions targets within reach, and second, by reducing the costs of clean energy technologies—in their words, “the most significant policy driver for global emissions reduction this century.”[1]

As a whole, the IRA may indeed offer this win-win.[2] But for at least one provision—the production tax credit (PTC) for clean hydrogen—there may be a trade-off. The government needs to choose between prioritizing domestic emissions reductions by setting up strict emissions accounting rules for projects to qualify for the highest level of the PTC, or prioritizing the rapid deployment and improvements of a technology that can help drive the global energy transition.

The IRA is written law, but the US Department of the Treasury[3] (Treasury) is now writing guidance on how the tax credits will be implemented, including how to measure emissions from hydrogen production. The current debate, similar to what occurred in Europe,[4] has focused on emissions from electrolysis-based hydrogen. This article details the range of arguments and explains why such an arcane issue has become so controversial.

🔥 What about we co-host a webinar? Let's educate, captivate, and convert the hydrogen economy!

Hydrogen Central is the global go-to online magazine for the hydrogen economy, we can help you host impactful webinars that become a global reference on your topic and are an evergreen source of leads. Click here to request more details

Background

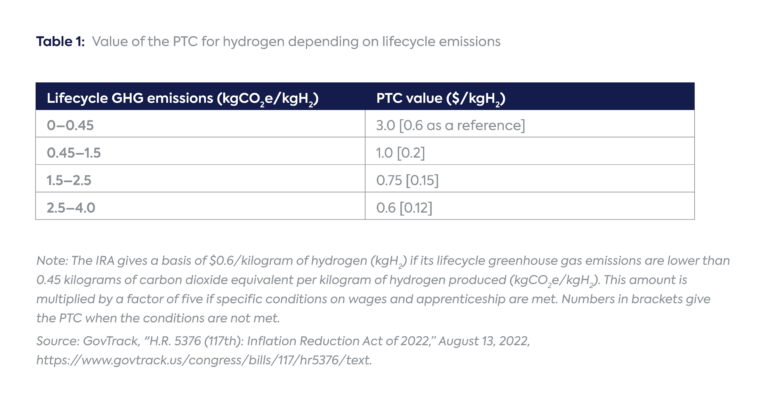

In the United States, the definition of clean hydrogen[5] encompasses various production methods, including electrolysis using renewable or nuclear power, fossil fuels with carbon capture and storage, and biomass or waste feedstocks.[6] The IRA differentiates them based on their carbon intensity (Table 1) and rewards those with the lowest carbon intensity with a PTC as high as $3 per kilogram of hydrogen (kgH2),[7] which could improve the economics of some clean hydrogen projects by over 50 percent.[8]

Why Count Electricity Emissions at All?

The IRA also includes tax credits for other technologies that run on electricity, including electric vehicles (EVs). Like clean hydrogen, EVs have the potential to provide carbon-free energy only when the grid is fully clean. The EV tax credits are not contingent on the emissions associated with electricity use. Why should clean hydrogen be any different?

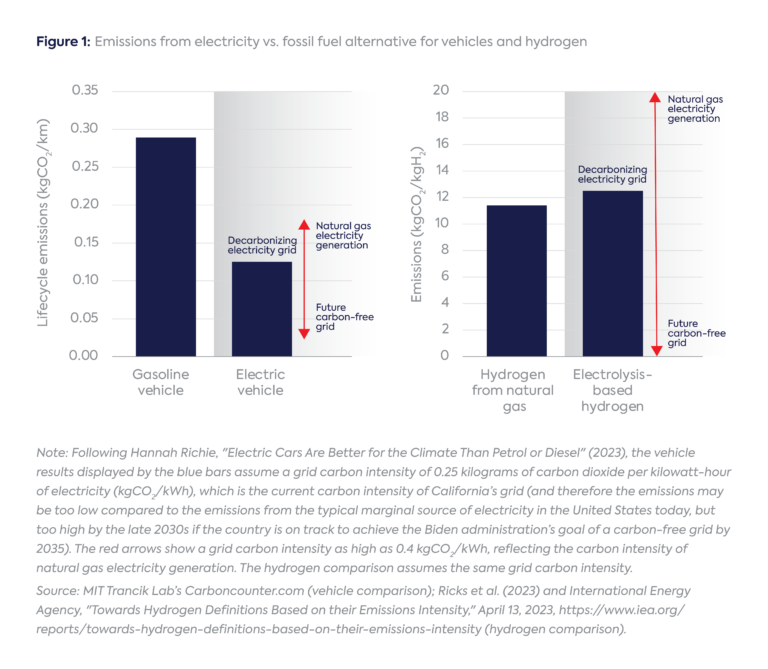

First, electric vehicles are more energy-efficient than gasoline-powered vehicles, which means a shift to EVs causes emissions to fall right away, even with electricity from current grids (Figure 1). In contrast, electrolysis is so electricity-intensive that hydrogen produced with the current US grid causes about twice as many emissions as current hydrogen production using natural gas.[9]

The text of the IRA is even more clear on why electricity emissions must count. “Qualified clean hydrogen” is defined based on “lifecycle greenhouse gas (GHG) emissions,” which means all emissions up to the point of hydrogen production, including the emissions associated with electricity production. Treasury simply is not allowed to treat clean hydrogen like EVs.

Strict Emissions Accounting Rules May Help Avoid Increases in Domestic Emissions

One prominent proposal asks Treasury to adopt strict emissions accounting rules that require hydrogen producers to match their consumption of electricity from the grid with clean electricity production on an hourly basis (“temporal matching”), and only using production that has been recently installed (“additionality”) nearby the hydrogen facility (“deliverability”).[10]

Their primary concern is to avoid increasing carbon dioxide emissions in the power sector. Companies often claim their electricity consumption is fully clean by purchasing megawatt-hours of renewable electricity production—for example, via renewable energy credits—in amounts that match their consumption from the grid each year.

A problem with these claims is that companies consume electricity at all hours, while renewables produce only at certain hours; increasingly, the challenge of decarbonizing grids is producing clean electricity during the hours when low-cost solar and wind are not producing.

A few years ago, Google estimated that procuring clean electricity to match its annual electricity consumption increased the percentage of its operating hours covered by clean energy from 39 to 61 percent[11]—a far cry from 100 percent clean.

The three proposed standards—temporal matching, additionality, and deliverability—aim to make hydrogen producers responsible for bringing their own clean electricity onto the grid. But they are imperfect proxies.[12]

For example, the goal of “additionality” is for clean electricity to be built as a result of a hydrogen facility, but a requirement to contract with recently built clean electricity projects does not ensure this goal is achieved because the clean electricity may have been built regardless. And a nationwide apparatus to reliably track clean energy production and consumption on an hourly basis is not available.[13]

Still, compared to more lenient alternatives, emissions will be lower with strict emissions accounting rules. With a host of highly uncertain assumptions, Rhodium Group estimates emissions savings of up to about 100 million metric tons (MMT) per year in 2030 from either the additionality, deliverability, or temporal matching criteria,[14] which is around 2 percent of US GHG emissions and larger than the annual CO2 savings that EPA expects from light- and medium-duty vehicle emissions standards.[15]

Even with the added costs of complying with strict rules, electricity-based hydrogen would likely become competitive over the next decade due to the effects of the PTC. However, strict rules could help avoid inefficient uses of hydrogen.

A concern is that the PTC incentive is so large—perhaps leading to subsidy-inclusive costs near zero in certain plausible cases—that it could attract unwise investments in clean hydrogen for energy uses where other clean energy options will eventually be more attractive, wasting taxpayer dollars in the process.

Less Strict Emissions Accounting Rules May Encourage Faster Deployment and Progress in Electrolyzers

Opponents of strict accounting rules argue against saddling hydrogen producers with the challenges of procuring new clean electricity at all hours or operating at a low load factor, which could stifle the deployment of electrolysis-based hydrogen.[16]

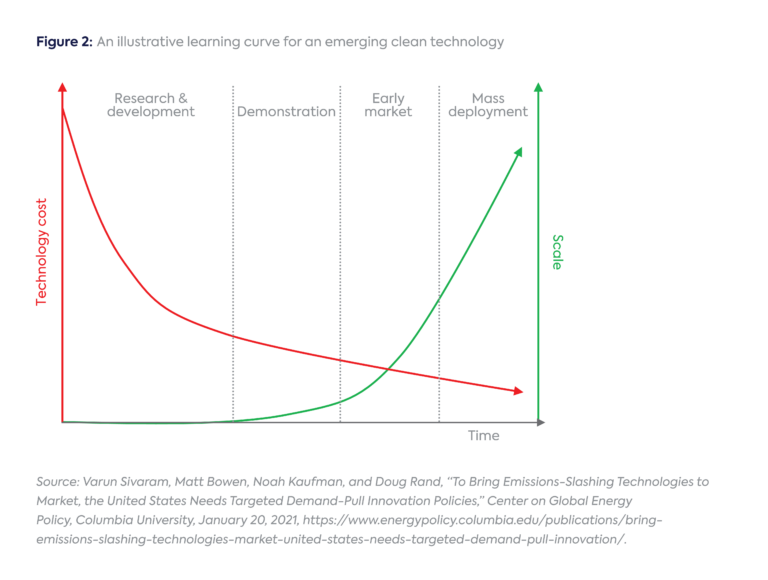

After all, the optimism surrounding clean hydrogen comes in large part from expectations of dramatic cost declines of electrolyzers as more are built, via the same “learning” processes that have made other clean energy technologies cheap (Figure 2).[17]

With technological improvements, clean hydrogen has the potential to address some of the world’s thorniest decarbonization challenges, such as steel production in the developing world. It may be premature to worry about clean hydrogen deploying too fast and in too many places, given that it comprises roughly none of the hydrogen market today.[18]

Conclusion

In a perfect world, Congress could help Treasury with legislation that ensures binding, credible emissions pathways and the rapid and equitable buildout of clean power. Treasury should not hold its breath. It will have to balance the competing priorities of reducing near-term domestic emissions and supporting a promising net-zero-consistent technology.

Additional questions may be just as important to Treasury’s decision. What was the intent of Congress? What emissions standards are realistically administrable and enforceable? The European Commission opted for monthly matching of electricity consumption, moving to hourly only by 2030,[19] and US rules will need to be at least as strict to export into the European market.

The extreme rhetoric on this issue may suggest Treasury has no good options—it can either do irrevocable damage to the clean hydrogen industry or to the climate. Fortunately, the evidence seems to suggest somewhat lower stakes—the hydrogen PTC is likely to encourage the early-stage commercialization of an important decarbonization technology, and Treasury’s decision will help determine the pace of deployments and the associated near-term emissions.

READ the latest news shaping the hydrogen market at Hydrogen Central

The Battle for the US Hydrogen Production Tax Credits, April 17, 2023